First, I have to say that we have known Energy Funders from its infancy and are proud to have invested through the platform, as well as found a visionary, Casey Minshew, that wants to usher the oil & gas industry into the digital age. A number of happenings in the last month at Energy Funders are important for the COVID-19 / Saudi – Russia price war events in the news, as well as how our economy is going to break out after these events.

With Mr. Minshew’s and Energy Funders’ express permission, we have reprinted 2 e-mails and embedded their last webinar.

Oil & Gas Industry Situation

This is an e-mail from May 15, 2020 from Casey Minshew, reprinted by permission:

![]() A Platform Designed for the New Era of Energy Funding

A Platform Designed for the New Era of Energy Funding

As you know, we spent the last five years iterating on a platform designed to disintermediate the old model of energy funding. From day one, our goal was to remove the flawed incentive structures and multiple layers of corporate expense standing between investors and the cash flow returns at the wellhead.

With the first two iterations, we built up a process and a platform for bridging this gap. Now, with the upcoming merger between Energy Funders and Paleo Resources, we have filled in the critical missing piece: a steady supply of high-quality inventory and proven operators for managing that inventory. By combining our platform with Paleo’s physical and human resource base, we can now offer investors the full suite of opportunities across our four fund models, catered to your risk/return preferences.

Through this new combination, we’re convinced that the next generation of the Energy Funders platform will deliver the best product and returns in our history. And the timing couldn’t be better. Today, we’re witnessing a profound shift in capital allocation trends across the E&P sector, which will set the stage for the most compelling macro environment for energy funding in over a decade. Let’s first step back to see how we got here.

Energy Economics Turned Upside Down

Over the last decade, a flood of cheap capital turned the economics of oil and gas production upside down. Instead of drilling wells for the sake of returning cash flow to investors, capital was allocated based on flawed incentive structures favoring asset gathering and top-line growth above all else.

As with every boom, asset prices inflated and far too many sub-par projects were funded using “other people’s money”. Many investment structures, including both public and private equity, failed to return investor capital even at $100 oil. And even when excess supply crashed the energy market in 2015 – 2016, the capital continued flowing. The Wall Street Journal explains:

“In the three years after crude prices crashed, private-equity firms raised nearly $200 billion to buy oil and gas assets, according to data provider Preqin. The idea was to buy at the bottom and sell for a profit when oil prices bounced back.”

In short, yesterday’s era of shale financing was less about cash flow returns and more about chasing growth and speculative asset flipping. The Energy Funders model was fundamentally built to sidestep this flawed industry focus on growth and speculation, by delivering direct access to the economics of individual wells.

During the previous era’s irrational funding environment, excess capital deployment created a scarcity of high-quality inventory that could be acquired on favorable terms. As a result, we have been fiercely competing for projects that meet our strict return objectives, and that scarcity has throttled our growth. But today, that’s all changing as the tide recedes on a decade of capital misallocation in the shale patch. This shift is driven by investor frustration after years of subpar returns, as one Bank of America analyst recently highlighted:

“The U.S. exploration-and-production sector has spent too much capital for too long with meager returns… This golden era of unlimited capital availability has now ended.”

Capital Retreats from the Shale Patch

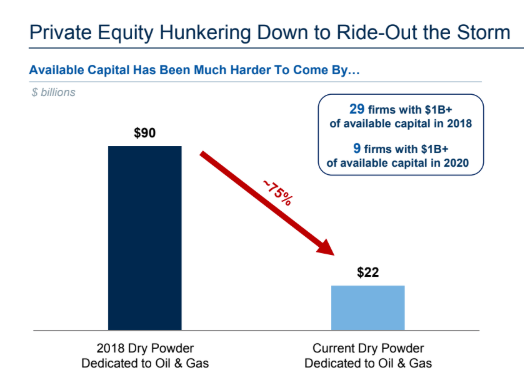

With investors refusing to throw good money after bad in the shale patch, capital is retreating across both public and private markets. Unlike the previous energy downturn in 2015 – 2016, data from RBC Capital Markets shows that the private equity funding for oil and gas is down 75% from $90 billion in 2018 to just $22 billion today:

Meanwhile, in the public markets, we’re seeing similar investor aversion to funding oil and gas companies in the high-yield debt market. The Financial Times reports:

“Among 240 high-yield mutual funds tracked by data provider Morningstar, about three-quarters have less than 10 percent of their assets invested in energy – much less than a neutral weighting of 14 percent.”

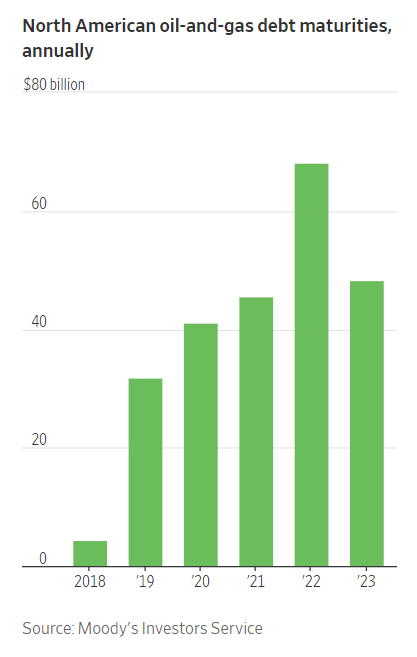

This lack of funding appetite will present a major headwind for the leveraged E&P sector going forward. Over the next five years, North American oil and gas companies face a $200 billion wall of debt maturities looming on the horizon:

With an endless supply of cheap external capital no longer available, E&P companies will be forced to divert much of their spare cash flow towards debt repayment for the next half-decade. Importantly, these debt burdens can’t be solved with one or two years of higher prices. For the companies that survive in the coming years, balance sheet repair and investor returns will take precedence over asset gathering and revenue growth.

A Structural Shift Towards Slower Growth and Higher Prices

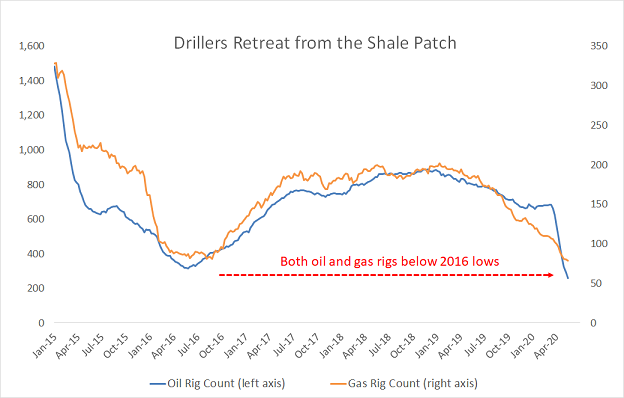

Looking ahead, we have all of the ingredients for a future environment of structurally lower production growth, along with higher commodity prices going forward. The process of supply rationalization is well underway, with the U.S. oil and gas rig counts recently falling below the levels last reached during the depths of the 2016 price crash.

The drop off in drilling activity, combined with widespread well shut-ins, has already taken 1.5 million barrels per day (b/d) of U.S. oil production offline. Meanwhile, we’re seeing signs of demand recovery in key regions like China. On Monday, Bloomberg reported Chinese oil demand had recovered to 13 million b/d, or down just 3% from the same month last year. That’s up from a 20% decline in the country’s oil use in March.

Of course, no one can know exactly how the Coronavirus pandemic will evolve as economies start reopening around the world. The inventory overhang built up over the last few months will likely take some time to work through, even if the global economy enjoys a rapid recovery. So while we don’t expect an immediate moonshot higher in oil prices, today’s restraint in capital availability and drilling activity makes the recovery in energy prices a question of “when” and not “if”.

In the meantime, many of the public and private energy funding models that failed to deliver investor returns at $100 oil will disappear completely in today’s price environment. And countless over-leveraged producers will soon find themselves unable to service their debts should prices remain trapped below $40 per barrel for any meaningful length of time. But this short-term distress in the oil patch will create tremendous opportunity for investors who allocate capital in this space going forward.

The Opportunity Created from Today’s Economic Disruption

In the past, competing with the large pools of institutional and private equity capital limited the opportunity set for our disciplined investment approach. The excess capital flowing into the shale industry drove up costs across the board, including land, lease, drilling, completion, and other oilfield service expenses. This price inflation eroded project economics for both unconventional and conventional projects.

But the silver lining from the economic shock of the Coronavirus is the acceleration of a long-overdue process – the return of rational economics in the U.S. energy industry. As the excess capital retreats and a wave of asset liquidations wash over the industry, we expect the prices of acquiring and operating energy assets will re-rate back in line with more rational economic fundamentals.

This means a massive expansion in the opportunity set of projects that meet our return criteria. In the coming months, investors seeking direct access to wellhead returns through the Energy Funders platform will enjoy a much greater volume of investment projects at attractive entry points.

As always, we will only put money to work in projects that can hit our investor return targets at current strip pricing. But if our long-term view of structurally lower production growth and higher prices plays out, then these return targets will come with an imbedded kicker of potential upside down the road.

With yesterday’s era of irrational economics fading into the past, we look forward to the tremendous opportunity ahead with the next generation of the Energy Funders platform.

Casey Minshew

Co-founder & CEO

www.energyfunders.com

O: 713.300.9996 C: 512.731.7723

E: Casey@EnergyFunders.com

Follow Us: Twitter | Linked In | Facebook

A new partnership for Energy Funders

May 29, 2020 e-mail from Casey Minshew, reprinted with permission:

![]() New Deal Structures and Talent to Energy Funders

New Deal Structures and Talent to Energy Funders

As you know, our mission at Energy Funders is to deliver direct access to oil and gas investments capable of generating above-market returns. Critical to this mission is building up a warehouse of project inventory, which we will soon secure with the upcoming Paleo Merger. We expect to close the transaction sometime next week.

By securing our own project inventory, the Paleo merger sets the stage for new collaborations that allow us to leverage our industry relationships with highly talented and experienced third party operators. Today, we’re excited to introduce our debut collaboration with industry RoxStars – Navneet (Nav) Behl and Rajeev (Raj) Lal, the co-founders of OilRox.

We are confident that this collaboration will add tremendous new value in curating, developing and operating the products soon to be released onto the platform. We will start introductions with OilRox CEO Nav Behl, who played a key role in launching the shale revolution through his work at one of America’s most innovative and successful shale companies.

Click to registerfor Tuesday’s live webinar to meet OilRox Resources.

The “Apple of Oil”

As an investor in the energy space, you’ve likely heard of EOG – the early pioneers of U.S. unconventional development. One analyst famously dubbed EOG the “Apple of Oil” for driving the industry forward with its innovative unconventional drilling and fracking techniques that sparked the shale oil revolution. More importantly, EOG’s laser focus on costs and margins made it one of the rare shale companies that actually generated investor returns along the way.

Nav played a key role in developing EOG’s shale program, by leveraging his unique industry background. Before joining EOG in the early 2000s, Nav spent three years in the late 90’s drilling horizontal wells in Oman. Before that, he spent the early part of his career learning the ins and outs of well-completion techniques in the oilfield service sector, working for industry leader Schlumberger.

Cracking the Code of Shale

Nav’s experience in horizontal drilling and well completion techniques made him a natural choice to help lead EOG’s team tasked with “cracking the code” of the Barnett Shale in the early 2000’s. He parlayed his experience in horizontal drilling techniques into the Barnett shale, plus introduced key new innovations like the plug and perforation system in 2005, which has now become standard practice throughout the industry.

Nav was a key member of the EOG team that ultimately led the way in successful development of the non-core Barnett formation in Johnson county and extension areas, unlocking vast quantities of natural gas previously considered trapped within the tight shale deposit. Even after this success, the industry remained skeptical that the same unconventional methods could work in oil-heavy basins. As the Financial Times explained in aa 2015 interview with EOG CEO Mark Papa…

“Conventional wisdom held that while small gas molecules might be able to slip through the tiny pore spaces in shale rocks, much larger oil molecules could not. ‘If you had taken a poll in 2005 of 1,000 industry executives, 999 of them would have said you cannot flow oil commercially through shales, because the hydrocarbon size of oil is too large,’ he (Mark Papa) says.”

Despite the industry skepticism, Mark Papa tasked Nav with building and leading the completions team that would apply learnings from the Barnet to the oil-heavy Eagle Ford basin in 2009. One of the key breakthroughs included the use of “high-intensity fracking” that involved pumping 3,000 – 4,000 pounds of sand per foot downhole with a slickwater fluid system, instead of conventional gel fluids.

Click to registerfor Tuesday’s live webinar to meet OilRox Resources.

This innovative approach exploited hydraulic energy to create complex fracture networks, a seemingly crazy idea at the time, until these wells churned out over 100,000 barrels of oil within the first 30 days of production in 2009 – 2010. The success Nav and his EOG team enjoyed in the Eagle Ford set the stage for the next 10 years of America’s “shale revolution”.

Putting Investors First through Margin Innovation

As you know, for many shale companies, top-line production growth often took precedence over bottom line investor returns, but not at EOG. The company’s engineers were constantly tasked with not only delivering innovation on the operational side of the equation, but on the cost and margin side as well. Nav played a major role in introducing several key initiatives that kept costs in check and supported margins.

When service companies were unwilling or unable to supply the necessary fracking recipes to optimize the fracking process, Nav parlayed his deep service industry experience to lead efforts to create EOG’s own customized fracking fluids. Meanwhile, as the leaders in using high-intensity fracking techniques, Nav and his team foresaw the massive role that low-cost sand would play in controlling the shale cost structure. So they became first movers in securing their own sand supply, with the purchase of their own sand mine in Hood County, Texas in 2007.

As soaring input costs prevented many shale companies from generating returns at $100 oil, the cost innovations Nav and his team introduced helped secure EOG’s position as a low-cost industry leader. Consider that even during the “lower for longer” price environment of the last five years, EOG managed to generate positive net income and free cash flow in every year outside of the 2016 price collapse.

This experience in both operational and cost innovation makes Nav a perfect fit for the Energy Funders mission.

His partner Rajeev (Raj) Lal, the OilRox COO, brings an equally valuable set of adjacent skills on the asset acquisition and development side of the industry. Nav and Raj met when pursuing their bachelor’s in petroleum engineering at the Indian School of Mines in Dhanbad, India. After college, they each followed their own paths – with Nav pursuing his Master’s from the University of Texas and MBA from MIT Sloan, and Raj heading further west to obtain a Master’s at Stanford in California.

Uncovering Hidden Gems in the Oil Patch

Before co-founding OilRox, Raj worked for private oil and gas producer Omimex group. Unlike many of the private operators who rely heavily on debt-financed acquisitions, Omimex pursued a disciplined approach of using little to no leverage. Instead, they focused on identifying underpriced assets with upside potential through organic development. As an example, Raj helped lead the acquisition and development of a $1.2 million block of assets in Reeves County, purchased in 2008. He led the team that developed those assets through reserve additions, which were later sold to oil supermajor British Petroleum for $20 million in 2019.

Raj also has a track record of creating value through accretive deal structuring. He recently took over the asset management of a legacy oilfield that was heavily burdened by a large overriding royalty interest (ORRI) in Grant County, Oklahoma. Future development of this project was hindered by operator’s low net royalty interest in the project. Raj proposed a creative revenue sharing structure to the BOK trust that managed the ORRI, which they accepted. This allowed both parties to benefit from field redevelopment via an infill drilling program, which boosted the proven reserve value (PV-10) of the field from $630,000 to $5.4 million in just three years.

Raj’s specialty in uncovering hidden gems in the oil patch, creating organic value through operational development and accretive deal structuring provides a nice complement to Nav’s drilling and completions expertise. Together, they share a disciplined and creative approach towards asset acquisition, development, and cost management. The end result: a team with talent across the energy value chain, with a proven track record driving investor returns.

Upcoming Webinar Will Showcase New Fund Opportunities

We couldn’t be more pleased with our new partnership with Nav and Raj, and the tremendous value they will add as we increase the scale and quality of our products going forward.

On that note, next Tuesday at 2:30 PM CST we’re hosting a webinar designed to introduce investors to the new fund product that will soon become available on the EnergyFunders platform. We’ll also explain why our new collaboration structure will expand the opportunity set beyond the traditional joint venture deal partnerships.

Click to registerfor Tuesday’s live webinar to meet OilRox Resources.

Casey Minshew

Co-founder & CEO

www.energyfunders.com

O: 713.300.9996

C: 512.731.7723

E: Casey@EnergyFunders.com

Follow Us: Twitter | Linked In | Facebook

Webinar

And here is the webinar that Casey refers to in the last e-mail:

Here is the legal disclaimer that was included on the e-mails:

LEGAL DISCLAIMER: THIS EMAIL AND COMMUNICATION IS INTENDED FOR ACCREDITED INVESTORS ONLY AND ONLY FOR THE RECIPIENT TO WHOM THIS EMAIL IS ADDRESSED. THE OFFERINGS ARE FOR ACCREDITED INVESTORS ONLY. This email message is intended only for the recipient to whom it is addressed and may contain information that is privileged and confidential. Nothing contained in this email constitutes tax, legal, insurance or investment advice, nor does it constitute a solicitation or an offer to buy or sell any security or other financial instrument. If you are not the intended recipient of this message, any use, dissemination, distribution or copying of this communication is strictly prohibited. If you have received this communication in error, please immediately notify the sender and permanently delete all copies that you may have. Oil and gas investments involve significant risk, may lose value, are not insured, and are not guaranteed. Energyfunders is intended for accredited investors only who are familiar with and willing to accept the risks associated with private investments, including the loss their entire investment. Such private investments are also subject to certain restrictions and are intended for investors who do not need a liquid investment. See Disclosure Memorandum for more information.

Offers or solicitations to buy or sell any securities are only be made through the Disclosure Memorandum, which contains important information about risks, fees, expenses, and details. EnergyFunders does not make investment recommendations or guarantees, and no communication through this website or in any other medium should be construed as such. Nothing on this website should be construed as investment, business, legal or tax advice. Past performance is not indicative of future performance. Investors are urged to conduct their own due diligence, not rely on any financial assumptions or estimates displayed on this website, and consult with legal, tax, and any other advisor that can help them understand and assess the metrics and risks associated with any investments.

By using EnergyFunders.com, you accept our Terms of Service & Privacy Policy, and agree to the Electronic Consent. If investing, you accept our Investor Agreement.

You may also view our Privacy Notice.