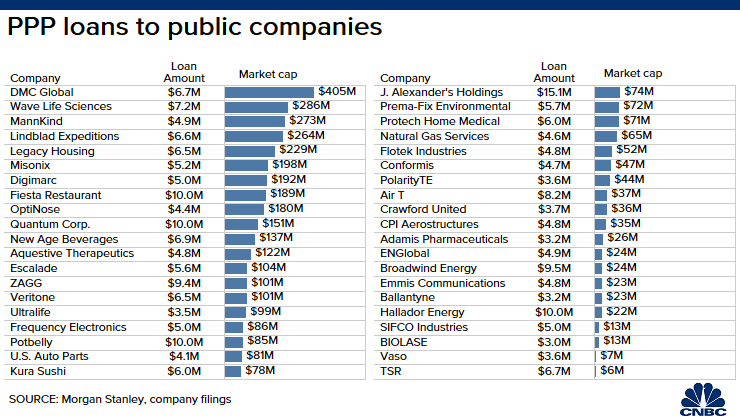

Normally, we don’t weigh in on the politically sensitive topics in the news, but there have been alarming acts of corporate insensitivity during this COVID-19 crisis – namely there was $243M out of the $345B in the Paycheck Protection Program (PPP) funneled to public companies, including some with market caps over $100M. ‘Good‘ corporate citizenship should include larger more established and stable corporate citizens, also known as PUBLIC COMPANIES outside of the micro-cap arena (that’s defined as having a market cap under $75M), lending a hand to truly small businesses.

But that’s not what has happened.

Corporate Citizenship Background

Here’s the background on the PPP – first and foremost, it was meant for ‘small businesses‘, which the United States Congress defined as those businesses with less than 500 employees. That’s the majority of businesses in the U.S., but everyone in business knows that you usually create many subsidiaries to manage risk, cash flow, taxes and other operational issues associated with employment. A single moderately sized 50 employee technology company could easily have 3 corporate entities – one for services, one for intellectual property, and one for reselling of products.

Next, let’s look at the job of a chief financial officer (‘CFO’). According to Wikipedia:

The chief financial officer (CFO) is the officer of a company that has primary responsibility for managing the company’s finances, including financial planning, management of financial risks, record-keeping, and financial reporting. In some sectors, the CFO is also responsible for analysis of data.

Wikipedia contributors. (2020, March 4). Chief financial officer. In Wikipedia, The Free Encyclopedia. Retrieved 16:17, April 22, 2020, from https://en.wikipedia.org/w/index.php?title=Chief_financial_officer&oldid=943909444

So each of the CFO’s of the public companies of what I would call LARGE companies (not in the sense of the public markets that discusses small cap as any public companies with market capitalization under $500M) were doing their jobs – how do we maximize the financial resources for MY COMPANY. And that’s where ‘good’ corporate citizenship broke down. The chief executive officer (CEO) should have shown some vision – that’s not what Congress meant for the PPP’s usage and stayed away. Technically, these companies are made of subsidiaries that are probably smaller than 500 employees, but, “let’s get ours before it’s not available…” pervaded the management ranks in these companies.

In my humble opinion, it wasn’t the CFO’s fault, it was the CEO’s (and board of directors) fault – no vision. No thought to good corporate citizenship.

Time to fire some CEO’s…

I hope public opinion swings horribly against these companies. They cheated, at the expense of the mom & pop companies that didn’t get anything. They’re going out of business en masses…

Corporate Citizenship gone awry

We’ve been following this play out in the press. Here’s Seeking Alpha’s breakfast message today:

There is a bright spotlight being thrown on where the funds from the original Paycheck Protection Program designed for small business went. The first-come, first-serve U.S. government aid program saw at least $243M of the total $349B funneled to publicly traded companies, including 15 with market caps of over $100M. As has been reported over the last week, the program ran dry before many mom-and-pop operations and smaller independent businesses were able to apply. Check out the list here.

Retrieved April 22, 2020, from Seeking Alpha website at https://seekingalpha.com/market-news/wall-street-breakfast?utm_medium=email&utm_source=seeking_alpha&mail_subject=wall-street-breakfast-stocks-attempt-rebound&utm_campaign=nl-wall-street-breakfast&utm_content=link-76.

Go deeper: Trump wants big companies to return PPP loans.

Then there’s a list on Seeking Alpha of the public companies that took loans from the PPP:

The list compiled by Morgan Stanley of those +$100M market cap companies nabbing PPL loans includes DMC Global (NASDAQ:BOOM), Wave Life Sciences (NASDAQ:WVE), MannKind (NASDAQ:MNKD), Lindblad Expeditions (NASDAQ:LIND), Legacy Housing (NASDAQ:LEGH), Misonix (NASDAQ:MSON), Digimarc (NASDAQ:DMRC), Fiesta Restaurant Group (NASDAQ:FRGI), OptiNose (NASDAQ:OPTN), Quantum Corp. (NASDAQ:QMCO), New Age Beverages (NASDAQ:NBEV), Aquestive Therapeutics (NASDAQ:AQST), Escalade (NASDAQ:ESCA), Zagg (NASDAQ:ZAGG) and Veritone (NASDAQ:VERI).

Retried April 22, 2020 from Seeking Alpha website at https://seekingalpha.com/news/3562741-publicly-traded-companies-raided-ppp-pantry?ifp=0&utm_medium=email&utm_source=seeking_alpha&mail_subject=wall-street-breakfast-stocks-attempt-rebound&utm_campaign=nl-wall-street-breakfast&utm_content=link-24

And President Donald Trump and Treasury Secretary Steven Mnuchin have both weighed in on this,

“they’re supposed to do it according to not only criteria, but according to what we think is right,” Trump said, while speaking Monday night at the White House’s daily coronavirus briefing.

Retrieved April 22, 2020 from MarketWatch at https://www.marketwatch.com/story/as-scores-of-public-companies-get-small-business-aid-trump-vows-to-take-back-money-if-help-was-inappropriate-2020-04-21.

The two CEO’s of Shake Shack, Danny Meyer and Randy Garutti (two subsidiaries, each with less than 500 employees) did the right thing – they decided to give their $10M back because they were blessed “to be able to access the additional capital we needed to ensure our long term stability through an equity transaction in the public markets”.

These guys have vision.

These guys also know the mantra, “never let a good crisis go wasted“. On the public relations side of the spectrum, these public CEO’s are touting their ‘good’ corporate citizenship. See their update on their website at their COVID-19 updates (since it looks like it may disappear later, we include it here to help demonstrate some key concepts:

For Union Square Hospitality Group, the decision as to whether or not to apply for PPP loans was more complicated. All USHG restaurants closed as of March 13th, and with no revenue, the company was forced to lay off over 2000 employees. Since the PPP loans would be forgivable only if employees were hired back by June, and since most USHG restaurants are based in New York City where that timeline is unlikely achievable for full service restaurants, that application decision relied upon our conviction that one day we would be able to pay back the loan. After careful consideration, USHG opted to apply for PPP loans, taking on the risk in order to hire back laid off employees as soon as possible. Some USHG loans have been funded, and we await the day we’re able to re-open.

Retrieved from the Shake Shack website on April 22, 2020 from https://www.shakeshack.com/updates/.

NOTE: Shake Shack did layoff 1,000 employees – their prerogative, but not quite why they got the PPP (CBS News article entitled “Paycheck Protection Program billions went to large companies and missed virus hot spots” at https://www.cbsnews.com/news/paycheck-protection-program-small-businesses-large-companies-coroanvirus/).

Shame

Out of the 26 portfolio clients that DSV Consulting LLC has, not a single one has received a single dollar from the PPP, even though every single one applied within 24 hours of their commercial banking relationship opened applications.

Out of the dozen other companies that we have discussed this with, 4 have received loans any where from $124,000 to $400,000. One of those organizations didn’t need it, but their CFO did their job well – but now it’s up to the CEO to be a ‘good’ corporate citizen.

Here are the companies and organizations that, in my opinion, should be shamed by public opinion. I’m not going to call for boycotting them, but I won’t ever grace their edifices ever again:

- Ruth’s Chris Steak House – $20M, with 5,000 employees

- Potbelly Sandwich Shop

- Quantum Corporation (data storage devices) – 800 employees, not shut down

- J Alexander’s Holdings

- Taco Cabana – $10M

Key Concepts

Here are the key concepts from this article:

- Corporate subsidiaries help manage risk, taxes and employment concerns.

- CFO’s look at every avenue for a company’s financial resources – that’s their job.

- ‘Good‘ corporate citizenship falls on the CEO to implement.

- Public markets provide easier access to capital at times of great need – transparency and investment rules established by the listing venue.

IF you read this and think that we’re onto something, why don’t you call us and have us work with you to put in place a board of advisors and corporate governance to ensure that you are a ‘good’ corporate citizen.

https://calendly.com/dsvconsult/new-clientFurther Resources

- U.S. Department of the Treasury – The CARES Act Provides Assistant to Small Businesses

- PPP Calculation Tool from the University of Chicago Booth School of Business accounting professor Michael Minnis

About DSV Consulting LLC

DSV Consulting LLC is a management consulting and merchant banking organization helping emerging businesses structure and achieve growth. With over 45 years of experience with emerging businesses up to $10M revenue, our professionals have experience in diverse industries – custom software development, training, merchant banking, private equity, maritime, and oil & gas.

Our management consulting is wrapped in a simple format – checklist based, focused on client specifics, and built to provide long term value to our clients. Our merchant banking services combines our management consulting concepts with our extensive network of professionals spanning accounting (CPA), auditing, broker dealers, litigators, securities lawyers, among others.