Every business owner eventually faces collecting sales & use taxes for the states where their companies are domiciled in. Many just go to the state’ s comptroller’s website page and register, but little do they know, that opens the door to audits by state authorities, fines when done incorrectly, and finally the morass that is collecting sales & use taxes in different locales – different zip codes within the state and different states. Recently I had a client that began reselling software products from third party developers. DSV Consulting LLC prepared a paper on the accepting sales taxes – we have included it here, both in the text and originally formatting so you can see what we can do for you…

In general, if you sell products and services in Texas and you have a “nexus” point or in other words have a physical location in Texas at which you do business, you need to collect sales tax and remit it to the State of Texas.

- Sales & Use Tax on Texas Comptroller’s site – https://comptroller.texas.gov/taxes/sales/

Types of Products & Services

What we are and must do, which comes from the website page https://comptroller.texas.gov/taxes/publications/96-259.php:

- Internet orders sold to Texas locations (https://comptroller.texas.gov/taxes/publications/94-171.php) – see the complete text of the website below

INTERNET ORDERS – BUYING AND SELLING

You might think you can save money by not paying tax when you buy or sell something on the Internet, but those sales are subject to sales tax.

Buying on the Internet

Whether the sale takes place online or in a store, Texas sellers must collect sales tax on taxable items sold and delivered to Texas locations. A seller is “engaged in business” in this state if they have a Texas outlet, office or location where they take orders for taxable items.

Is there sales tax on delivery charges?

Yes. Charges for transportation or delivery to a Texas location, both before and after the sale, are considered to be services or expenses connected to the sale and thus taxable. These charges are taxable even if stated separately from the sales price.

What if I buy something out-of-state? Is there still tax due?

A taxable item that is shipped from outside the state directly to a Texas customer is subject to Texas use tax at the location where the customer takes delivery. Use tax rates are the same as sales tax rates.

Some companies voluntarily collect the Texas use tax, while others must collect it because they have some form of physical representation in Texas. An out-of-state seller is not required to collect Texas tax if the seller only conducts business in Texas from out-of-state by mail, telephone, or via the Internet, but this seller can choose to apply for a permit and voluntarily collect Texas tax from its Texas customers. On the other hand, an out-of-state seller must get a Texas permit and collect Texas tax if the seller has Texas outlets, Texas salespersons, or otherwise comes into Texas to conduct business, such as soliciting sales, performing services, or making deliveries. The Comptroller’s office closely monitors out-of-state sellers to make sure they properly report and remit the tax they collect.

What should I do if the out-of-state seller does not collect Texas use tax?

If the seller did not collect Texas use tax, then you can report it directly to the Comptroller’s office. If you don’t have a sales tax permit, you can file an “occasional use tax” return, Form 01-156 (PDF). Reporting use tax that is due helps put out-of-state vendors on an equal footing with Texas vendors.

What if I paid the other state’s sales tax? Isn’t that double taxation?

You can take a credit on the Texas use tax you may owe for the amount of sales tax paid to another state. Check your billing statement to see if you paid another state’s sales tax or if the seller collected Texas use tax.

Selling on the Internet

I’m thinking about selling on e-Bay or from my own website – do I have to collect tax?

If you live in Texas, sell more than two taxable items in a 12-month period and ship or deliver those items to customers in Texas, you are required by law to have a Texas sales tax permit.

You also must have a Texas permit if you live outside the state but are engaged in business here. An out-of-state seller must get a Texas permit and collect Texas tax if the seller has Texas outlets, Texas salespersons, or otherwise comes into Texas to conduct business, such as soliciting sales, performing services, or making deliveries. An out-of-state seller is subject to Texas sales and use tax in the same way as sales made by any other retail business located in Texas.

If the above conditions apply, you are required by law to collect, report and remit the appropriate state and local sales and use tax on taxable items delivered to customers in Texas. The sales price includes all shipping and handling charges. “Taxable items” include all tangible personal property as well as taxable services. For a list of the services taxable in Texas, see our publication 96-259, Taxable Services (PDF).

How do I get a sales tax permit?

You can apply for a sales tax permit using Form AP-201 (PDF). Helpful information on starting a new business is available online.

What if I sell to customers outside of Texas?

You do not need to collect sales tax on items you deliver directly to out-of-state locations. To document such a sale, your records must include proof of delivery, such as a bill of lading, a shipping invoice or a postal receipt. You may have to collect tax in another state if you are engaged in business there. You should contact the states where you buy or ship merchandise to find out if you are responsible for paying or collecting their taxes. The Multistate Tax Commission has a useful website at http://www.mtc.gov with links to the tax websites of other states.

How much is sales tax?

The current state sales tax rate on taxable items delivered into Texas is 6.25 percent. Local sales and use taxes may be due depending on where you receive orders and where the products are delivered. You should not collect more than 2 percent local tax on any one transaction. To find out the proper rate for any jurisdiction, use our tax rate search engine. More information on local sales and use taxes is available online.

How do I buy things tax free?

When you buy items that you intend to resell in the regular course of business, you can give your supplier a properly completed Texas resale certificate in lieu of paying Texas sales tax. You can buy these items tax free since you will be collecting sales tax from your customers.

For more information about seller and purchaser’s responsibilities, see our Rule 3.286 and other sales tax information online.

94-171

(02/2006)

We are not:

- Information service, but if we had a newsletter or threat monitoring subscription[1] we would have to collect sales tax on it (https://comptroller.texas.gov/taxes/publications/94-109.php)

- Marketplace provider, which would be required to collect all sales tax in the state of Texas (like Steam, Amazon, etc.) (https://comptroller.texas.gov/taxes/sales/marketplace-providers-sellers.php). We are a marketplace seller, which if Steam certifies that they collect sales tax on our behalf, we are not responsible for collecting the sales tax. Here ARE the details for Marketplace sellers directly from their website:

Marketplace Sellers

Sales Tax

As a marketplace seller, you are not responsible for collecting and remitting sales and use tax on your sales through the marketplace if the marketplace provider has certified they are assuming these responsibilities. If the marketplace provider does not issue any type of certification that it is collecting sales and use tax on your behalf, then you should collect sales and use tax until you receive a certification.

If you are a Texas seller and sell through a marketplace, you are still responsible for having a Texas tax permit and filing your sales and use tax returns timely. This is true even if your only sales are through a marketplace provider.

Remote sellers that only sell through a marketplace provider that has certified they will collect sales and use tax on your behalf are not required to hold a Texas tax permit. However, you must keep required records of your marketplace sales for at least four years.

- Security service, which taxes all security services which “a license is required by the Private Security Bureau of the Texas Department of Public Safety under sections 1702.101 or 1702.102 of the Texas Occupations Code” (https://comptroller.texas.gov/taxes/publications/96-259.php).

Care must be given to realize that their website does reference taxable services do include computer forensics but looks like only related to criminal matters. “Taxable security services also include computer forensic services that constitute the analysis of computer-based data, particularly hidden, temporary, deleted, protected or encrypted files, for the purpose of discovering information related (generally) to the causes of events or the conduct of persons; as well as computer repair and support services that include reviewing computer data for the purpose of investigating potential criminal or civil matters.”

The website () does provide that non-taxable security services include all those services that fall under the following requirements (https://comptroller.texas.gov/taxes/publications/94-119.php):

temporary security services that meet all the following requirements:

security service is performed by a temporary help service for an employer to supplement their existing security service personnel on a temporary basis;

security service is normally performed by the employer’s own employees,

employer provides all supplies and equipment necessary; and

temporary employee is under the direct or general supervision of the employer to whom the service is furnished.

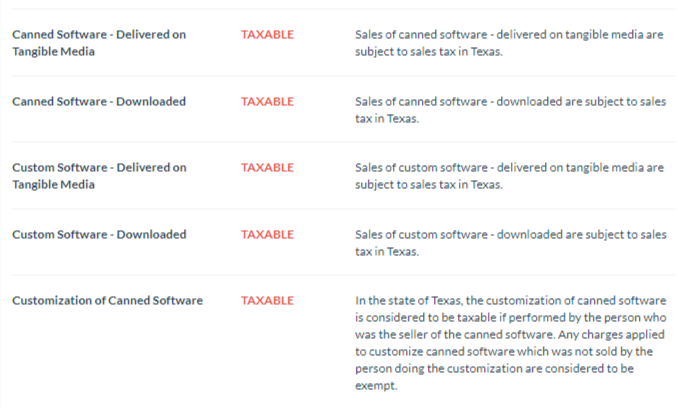

Software and related services

Information from $alesTax Handbook at https://www.salestaxhandbook.com/texas/sales-tax-taxability/software-and-digital-products:

While Texas’ sales tax generally applies to most transactions, certain items have special treatment in many states when it comes to sales taxes. This page describes the taxability of software and digital products in Texas, including canned software – delivered on tangible media, canned software – downloaded, custom software – delivered on tangible media, custom software – downloaded, customization of canned software and digital products. To learn more, see a full list of taxable and tax-exempt items in Texas.

Other states

There was a decision by the U.S. Supreme Court, South Dakota v. Wayfair, that established that states can now impose tax collection responsibilities on sellers who have an economic presence without any physical presence. To this extent, whenever we sell anything in another state other than Texas, we need to determine the sales tax requirements.

FYI, Texas law establishes a safe harbor that if revenue in the state is less than $500,000 for “remote sellers” then they are not required to collect sales tax. Here is the Texas information on that:

REMOTE SELLERS

In the 2018 South Dakota v. Wayfair decision, the U.S. Supreme Court overruled two previous decisions that held that a state can only require sellers of goods and services to collect tax when they have a physical presence in the state. As a result of South Dakota v. Wayfair, states can now impose tax collection responsibilities on sellers who have an economic presence without any physical presence.

What is a Remote Seller?

Remote sellers are out-of-state sellers whose only activity in Texas is the remote solicitation of sales. Remote sellers have Texas tax collection and reporting obligations if they have economic nexus in this state. If you have a physical presence in this state (i.e., business location, salespersons, representatives, etc.), you are not a remote seller.

Remote solicitation of sales includes activities such as soliciting sales through

the internet

telephone

radio or television

catalogs or flyers

Sales Tax

The law provides a safe harbor: Remote sellers with total Texas revenue of less than $500,000 in the preceding twelve calendar months are not required to obtain a tax permit or collect, report and remit sales and use tax. Your total Texas revenue is based on gross revenue from taxable and nontaxable sales of tangible personal property and services into Texas. The amount includes separately stated handling, transportation, installation and other similar fees you collect. It also includes sales for resale and sales to exempt entities.

Local Sales Tax

General Rule

Local sales tax is due at the location in Texas where the order is shipped or delivered when the order is not received or fulfilled from a Texas place of business. You can use our Sales Tax Rate Locator to search for sales tax rates by address.

The Single Local Use Tax Rate

The single local use tax rate is an alternative local tax rate that remote sellers can use instead of collecting and remitting the total local tax in effect at the destination address. The current single local use tax rate is 1.75 percent, and the rate is published in the Texas Register by Jan. 1 of each year.

Remote sellers can choose to collect the alternate single local use tax rate. Businesses located in Texas are not remote sellers and cannot use the single local use tax rate for sales. Additionally, the single local use tax rate is not available to any marketplace provider collecting taxes on behalf of marketplace sellers.

If you are a remote seller that chooses to collect the single local use tax, you must notify the Comptroller’s office in writing of your election using Form 01-799, Remote Seller’s Intent to Elect or Revoke Use of Single Local Use Tax Rate (PDF) by email or mail. The effective date must be on the beginning date of a reporting period.

Franchise Tax

The Texas franchise tax is a privilege tax imposed on each taxable entity formed, organized or doing business in Texas.

A foreign (i.e., out-of-state) taxable entity with annual gross receipts of $500,000 or more from business in Texas has economic nexus even if the entity has no physical presence in this state. This economic nexus provision applies to reports due on or after January 1, 2020.

[1] We need to review how others do this to ensure that we do not conflict with collection requirements.

Further resources

Here is the original PDF for your reference:

Here are further resources on the DSV Consulting LLC website:

- Accounting software for SMB’s, always a must for keeping track of sales & use tax collected

About DSV Consulting LLC

DSV Consulting LLC is a management consulting and merchant banking organization helping emerging businesses structure and achieve growth. With over 45 years of experience with emerging businesses up to $10M revenue, our professionals have experience in diverse industries – custom software development, training, merchant banking, private equity, maritime, and oil & gas.

Our management consulting is wrapped in a simple format – checklist based, focused on client specifics, and built to provide long term value to our clients. Our merchant banking services combines our management consulting concepts with our extensive network of professionals spanning accounting (CPA), auditing, broker dealers, litigators, securities lawyers, among others.